One of the many changes accelerated during 2020 due to COVID-19 was the digitization of companies’ sales channels, allowing them in many cases to maintain their sales or even see an increase.

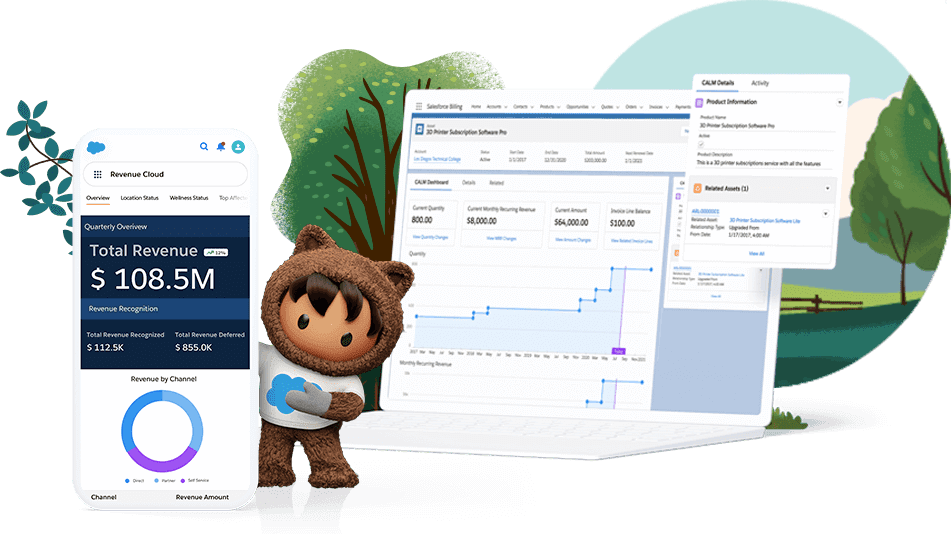

Revenue Cloud responds to the need of the commercial and financial departments of companies to have omnichannel control over their sales, contact and billing, reducing inefficiencies and allowing them to really focus on sales and how to increase them.

What is Revenue Cloud?

Revenue Cloud is the combination of existing Salesforce products reinforced with new products and features to extend the 360-degree view of the customer, including relevant information such as purchases and billing.

So what makes up Revenue Cloud?

This cloud is composed of different complementary verticals, which can be purchased together or separately:

- CPQ: facilitates the configuration of product, price and budget.

- Billing: as its name suggests, Billing optimizes the customer billing process. It is now enhanced by becoming Multicloud and covers all commercial channels: direct sales or B2B Commerce Cloud). In this way, the finance department has a single source for receiving invoices.

- Advanced Approvals: to streamline management and approval criteria.

- CPQ for Experience Cloud: CPQ for Partner Communities and CPQ for Customer Communities.

There are also several new options presented to us in Revenue Cloud: - B2B Commerce Connector: This is where the magic of innovation begins. The connector has been enhanced to provide sales teams with all the information about purchases and the financial department with billing information. What’s more, they have incorporated a billing model for subscription sales.

- Vlocity: This new Salesforce acquisition adds value to the Revenue Cloud with its power and pre-configured solutions for industries.

How should I align my Sales and Finance teams?

Salesforce Billing is the answer to this question and the best way to explain it is by following a sales pipeline.

Imagine the sales team creates a quote that the customer accepts. Once accepted, an order is generated. This order will only be invoiced when it is active, for example because the customer activation date is defined with a certain criteria. Once active, the invoice is created manually or automatically, which in turn has the ability to be issued on the fly or scheduled for delivery. No more emails back and forth to confirm products/services can be invoiced!

The great potential of this product lies in the self-management capacity of this invoice, which is capable of, for example, validating the use of a product in the order (in the case of “pay per use” invoicing) or, as mentioned above, scheduling recurring invoices.

Why Revenue Cloud?

- Omnichannel: no matter where the customer makes the purchase from, sales reps can access that information to either resolve a customer’s question and offer a discount, or to follow up on a sale or an abandoned shopping cart.

- Empower and simplify data analysis, improving the decision making process to make the necessary changes to incorporate new products and sales channels, or modifications to the sales process.

- Automate your company’s billing processes.

If you’d like to learn more about how Revenue Cloud and other Salesforce solutions can improve your business performance, we’d be happy to tell you about best practices for your industry, analyze your particular case and provide value tailored to your needs.

Bárbara García. Senior Consultant